Lenders want to have protection in case you were to default on the loan. Mortgage insurance: You will likely have to pay mortgage insurance if your down payment is less than 20%.This cost is split into 12 installments and collected each month with your mortgage payment. Property tax: The county where the home is located will dictate your property tax percentage.For example if your loan amount is $300,000, and your interest rate is 5.5%, you would pay $16,500 in interest for the first year (0.055 x 300,000 = 16,500). Interest rate: This is the annual rate your lender charges for borrowing the loan.For example, if you purchase a $300,000 house and put down 10%, your principal would be $270,000. Principal: This is the amount you owe on your mortgage minus the down payment you made.Here’s a breakdown of key factors that affect your monthly mortgage payment: Increase your down payment: If you can make a higher down payment than what is required, this can be a good way to lower your monthly mortgage payment.If your credit score is low, it might be a good idea to work on improving your score before applying for a home loan. Work on your credit score: Homebuyers with excellent credit scores are typically offered the best mortgage terms.Shop interest rates: It’s important to compare different lenders and loan types to have the best chance in securing a low interest rate.This may mean lowering your home purchase budget and finding a home in need of improvements. Adjust your homebuying budget: If your monthly mortgage payment is too high, you may want to reconsider how much you can actually afford.However, you will pay more interest since it is a longer loan term. Lengthen the term of the loan: If you plan to live in the home for a while, extending your loan term from 15 years to 30 years can help lower your monthly payment.If you calculate your monthly mortgage payment and it is not as low as you hoped for, there are a few ways you can lower it:

#MORTGAGE CALCULATOR INTEREST HOW TO#

How to Lower Your Monthly Mortgage Payment These are both important factors in determining your monthly mortgage payment, so we recommend including them if possible.

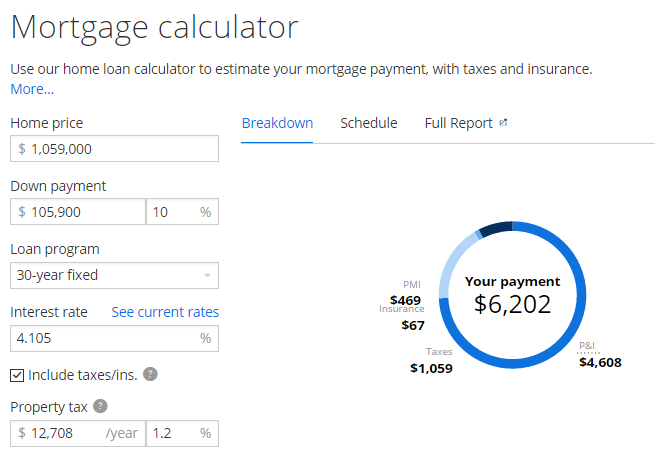

Loan term: The length of time, in years, that you'll be making payments on your loan.Interest rate: This is the annual interest rate on your loan.Down payment: The amount of money you're putting down upfront towards the purchase of your home.Home value: The estimated market value of the home you're interested in buying.Here’s a closer look at each component of the mortgage calculator: You can also select whether you want to include property taxes and homeowners insurance in your calculation. To use our mortgage calculator, enter your home value, down payment, interest rate, loan term and credit score. How to Calculate Your Estimated Monthly Mortgage Payment

0 kommentar(er)

0 kommentar(er)